Loan Application Redesign

Project Overview

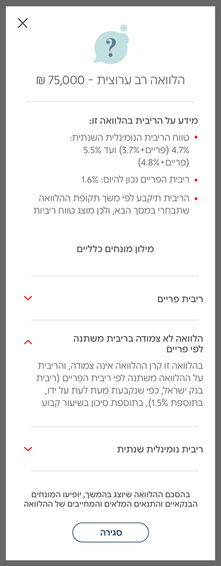

Redesign of the loan application flow in Bank Hapoalim’s mobile app. The original process was fragmented, lengthy, and confusing. The goal was to create a simplified five-screen flow that integrates regulatory requirements, improves usability, and ensures consistency with the bank’s design system.

Market Overview

Before diving into design, I conducted a market analysis of Israel’s leading banks to understand trends, strengths, and gaps in digital lending experiences.

Bank Leumi

Focus: Digital-first automation and rapid service.

Size: Israel’s largest bank by assets.

Key Solutions: Pioneered a fully online mortgage process, cutting approval time from ~14 days to 48 hours.

Achievements: Boosted mortgage volume by 500%, recognized as the most digital bank in Israel.

Israel Discount Bank (IDB)

Focus: Customer support innovation with fintech integration.

Size: One of the country’s top three banks, with 112 branches nationwide.

Key Solutions: Introduced “Didi,” an AI-powered assistant, and launched the award-winning Business+ mobile app.

Achievements: International recognition from Gartner and IT Awards for innovation in digital banking.

Mizrahi-Tefahot Bank

Focus: Leading mortgage provider with strong retail presence.

Size: Israel’s fourth-largest bank, operating 140+ branches.

Key Solutions: Hybrid digital–branch model that simplifies mortgage and personal loan management.

Achievements: Consistently holds the largest mortgage market share in Israel (~36%).

Summary

Leumi emphasizes speed and automation, Discount highlights AI-driven support, and Mizrahi-Tefahot demonstrates the strength of hybrid mortgage leadership. Together, these insights revealed a market moving toward clarity, speed, and user empowerment, guiding my redesign process at Bank Hapoalim.

Target Users

Through research and competitor benchmarking, three main user groups emerged as primary loan applicants:

Young Professionals

Digital-native individuals in their 20s–30s, seeking fast personal loans for studies, travel, or early-stage investments.

Pain Points

Overwhelmed by long, bureaucratic flows.

Confusion around required documents and eligibility.

Lack of immediate feedback creates frustration.

Proposed Solutions

-

Streamlined Flow: Short, intuitive steps with progress indicators.

-

Smart Guidance: Contextual tooltips and document checklists.

-

Instant Feedback: Real-time eligibility checks and status updates.

Families

Adults managing household expenses, renovations, or educational costs, who value clarity, guidance, and financial stability.

Pain Points

Difficulty comparing loan types and understanding repayment terms.

Financial jargon creates stress and lack of trust.

Limited transparency about process timeline.

Proposed Solutions

-

Comparison Tools: Side-by-side visualization of loan types, rates, and repayment options.

-

Clear Language: UI content simplified with microcopy and supportive visuals.

-

Process Transparency: A timeline view showing each stage of the loan journey.

Small Business Owners

Entrepreneurs in need of working capital or business expansion loans, requiring flexible options and transparency.

Pain Points

Inflexible loan options not adapted to dynamic business needs.

Fragmented experience between digital platforms and in-branch processes.

Poor visibility into loan status, leading to uncertainty.

Proposed Solutions

-

Flexible Products: Modular loan packages tailored to business scale and cash flow.

-

Hybrid Integration: Consistency between app, web, and branch experiences.

-

Dashboard Tracking: Centralized view of loan status, repayments, and upcoming deadlines.

Empathy Map

Says

-

“I just need this loan process to be quick and simple.”

-

“I’m not sure what documents I still need to upload.”

-

“Why does this take so long? Can’t it be digital?”

-

“I wish I could track what’s happening right now.”

Does

-

Opens the banking app multiple times to check status.

-

Calls the call center or visits a branch for clarification.

-

Switches between web, mobile, and offline documents.

-

Abandons the flow if it feels too overwhelming.

Pains

-

Long, fragmented flows with repetitive steps.

-

Lack of transparency about progress and timelines.

-

Unclear documentation requirements.

-

Inconsistent experience across digital and physical channels.

Thinks

-

“Am I even eligible for this loan?”

-

“If I make a mistake, will it get rejected?”

-

“This app should be smarter and guide me, not confuse me.”

-

“I want to feel in control of my finances.”

Feels

-

Frustrated by unclear instructions.

-

Anxious about approval/rejection.

-

Overwhelmed by jargon and lengthy forms.

-

Relieved when the interface feels simple, human, and consistent.

Gains

-

A clean, guided flow with clear next steps.

-

Transparent progress tracker and time estimates.

-

Easy document upload (camera, PDF, gallery).

-

Friendly microcopy and visuals that reduce stress.

-

A consistent design language that builds trust.

Design Implication

The empathy map highlights not only the functional needs (clarity, speed, transparency) but also the emotional layer, trust, confidence, and a sense of control.

This dual perspective shaped both the UX flow and the UI design choices (visual hierarchy, tone of voice, and consistency with the design system).

Project Goals

-

Simplify the flow into five clear steps.

-

Integrate regulatory requirements seamlessly.

-

Improve transparency and user confidence.

-

Ensure visual and functional consistency across channels.

-

Support diverse user needs.

Design Principles

-

Clarity Simple language and clean layouts.

-

Consistency Alignment with the design system.

-

Transparency Visible progress and summaries.

-

Empathy Reduce stress through supportive microcopy and visuals.

-

Flexibility Adapt to young professionals, families, and businesses.

Before Redesign

Long, fragmented flow with many clicks and unclear steps

User Journey – Before vs. After

Before (Old Flow)

Long, fragmented, many clicks, evolving screens.

Users confused about best loan option.

Regulatory steps scattered, adding friction.

Extended journey, often abandoned.

Key Improvements

Reduced complexity and clicks

Supported decision-making with comparison tools

Balanced regulation with usability

Increased transparency and clarity

After (Redesigned Flow)

Guided, intuitive flow with five key screens.

Loan comparison: best offer + two alternatives.

Regulatory steps integrated smoothly (goal selection + credit data consent).

Condensed flow: Goal → Consent → Loan Options → Summary → Completion.

After Redesign

Streamlined five-screen journey with clarity, transparency, and guidance

UI & Visual Design

The redesign remained fully consistent with the bank’s design system in terms of components, grids, and patterns.

At the same time, I introduced a new visual layer:

custom illustrations integrated into the flow, serving not just as decoration but as part of the user experience.

To develop the visual concept efficiently, I used AI tools to accelerate sketch production and speed up alignment with stakeholders, including business teams, the design studio, and UI & visual design partners.

Each illustration was designed as a contextual background to support the user’s journey. For example, in the goal selection screen (the first step of the flow), the entire process adapts visually to the chosen purpose. If the user selects “vacation” as the goal, the flow includes travel-related elements such as a suitcase, airplane, and light, uplifting imagery. This approach added warmth, clarity, and emotional engagement to an otherwise highly technical process.

Examples of the narrative illustration for the first and last screens of the flow, in different contexts (a loan for purchasing a car, and a loan for a vacation).

Key Takeaways

-

Reduced process from many steps to five streamlined screens.

-

Integrated regulatory needs without harming usability.

-

Added loan comparison for informed decisions.

-

Increased transparency and trust with summary and completion.

-

Strengthened consistency via design system alignment.

-

Introduced contextual illustrations as part of the UI, adapting visuals to the user’s chosen goal (e.g., vacation elements for a travel loan), adding warmth and engagement to the flow.